GET PEACE OF MIND TODAY

Going solar is feasible with Vivint

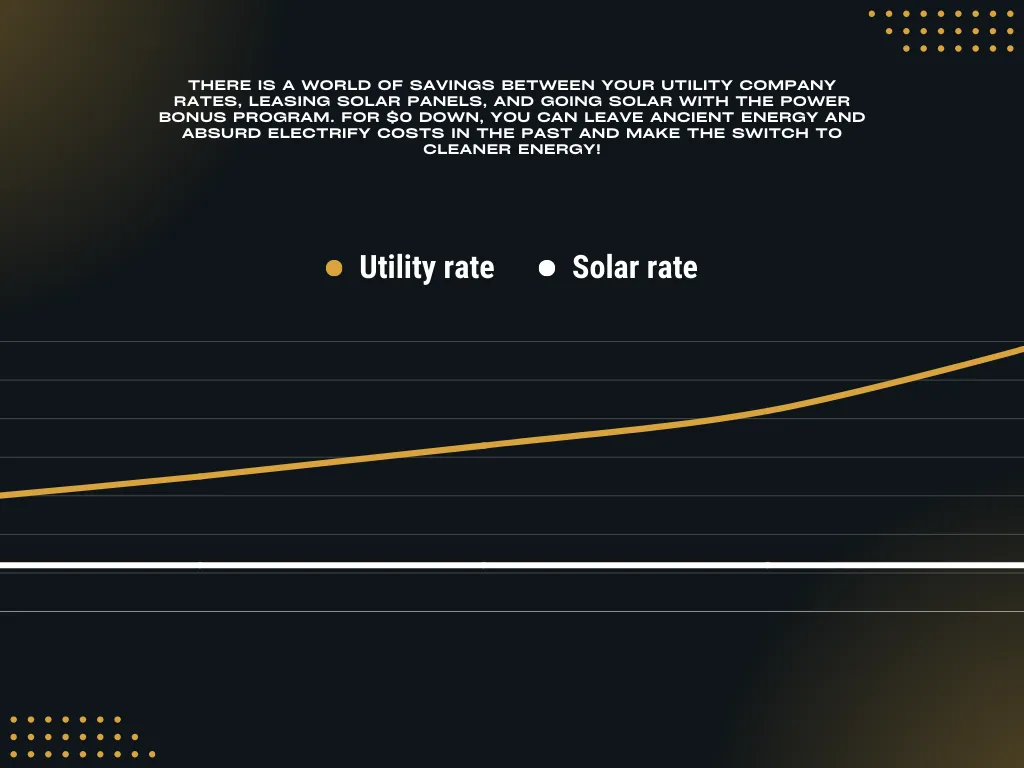

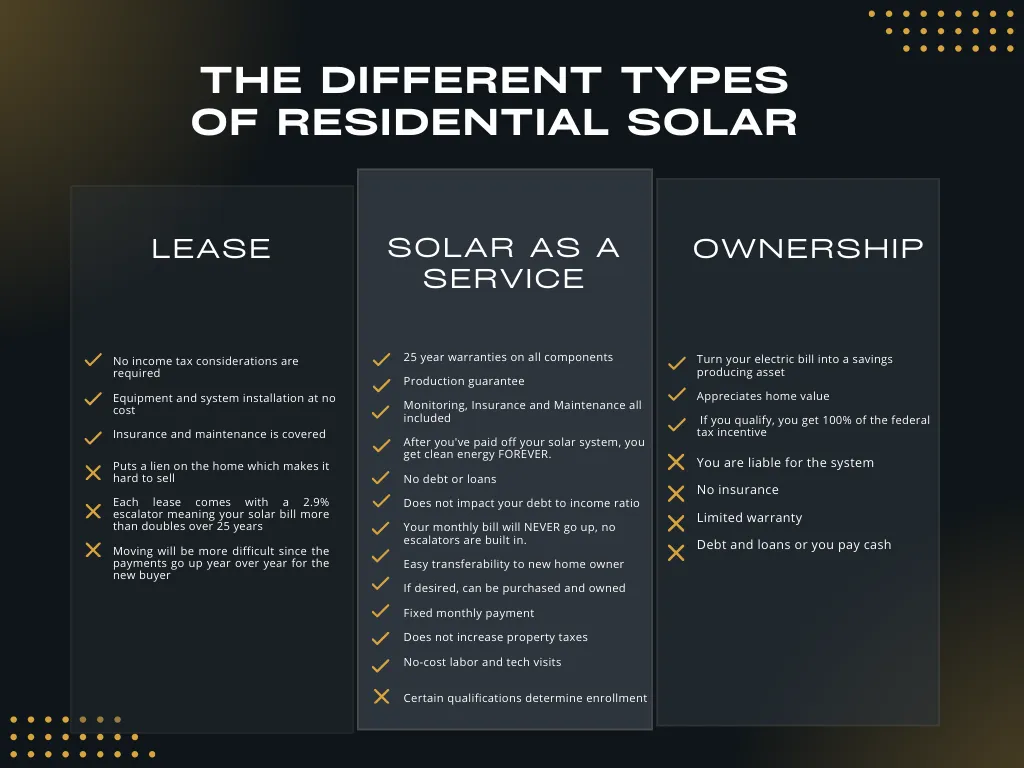

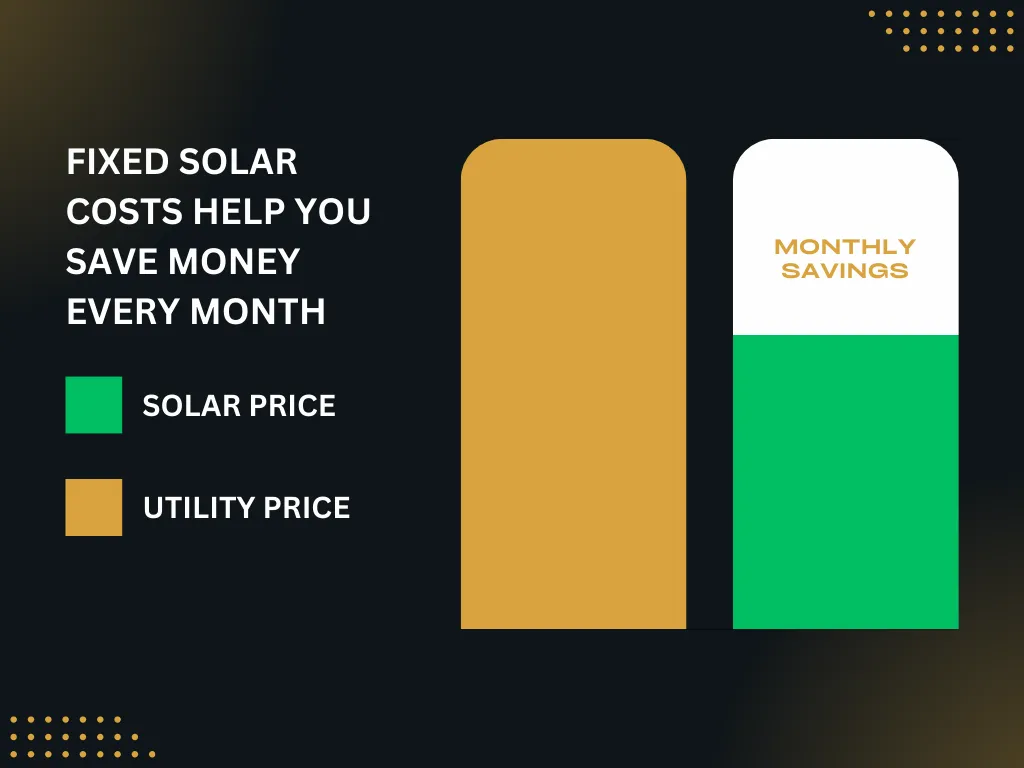

Let Vivint take care of the initial costs of converting to solar. Choose Solar as a Service where we replace your current rising energy bill with a lower monthly price for electricity with little to no money down if you’re eligible.

Is a Solar as a Service right for you?

The developer potentially offsets the customer’s electric utility bill. The developer takes care of getting the solar energy system up and running at little or no cost to the customer—from design and financing to permits and installation. The customer pays for the power generated at a fixed rate, typically lower than what the power company charges you.

Call 702-710-2672 now to talk to a specialist

Save up to $300 a year on your annual smart home bill

Power your home with solar from Vivint and save up to $300 a year smart home monitoring service. As a Vivint customer, you get the best price on smart security and smart energy.

Financial incentives for going solar

FEDERAL SOLAR INCENTIVES

Federal Solar Investment Tax Credit (Solar ITC)

The Solar ITC is available to all U.S. residents who owe federal taxes. With it, a portion of your project costs can be deducted from your tax obligation, reducing the amount of taxes you owe. The credit is worth 26% of your project costs in 2022, 22% in 2023, then expires for residential projects at the start of 2024. On a $10,000 solar project, the credit would put $2,600 back in your pocket, significantly speeding up your payback period.

STATE SOLAR INCENTIVES

Solar tax credits available by state

There are also state solar incentives and city-level programs available to encourage solar adoption. In most cases, state and local programs stack with the federal incentive, meaning you save even more. We’ll help you find all applicable solar rebates and apply them to the cost of your system. Solar incentives vary among states and utility companies, and rebate levels can fluctuate. Give us a call for the most up-to-date information about current state solar incentives.

SRECS

Be compensated for your energy credits

In participating states, homeowners receive energy credits for the solar power they produce, called Solar Renewable Energy Certificates (SRECs). State regulations require utility companies to generate a certain amount of electricity from renewable sources. Utility companies buy SRECs from homeowners to meet these requirements. In short, you are compensated for generating clean energy.

Copyright © 2024. Vivint, Inc. All rights reserved.